Introducing the VA Streamline Refinance (IRRRL)

Hello and welcome to your comprehensive guide on the Interest Rate Reduction Refinance Loan (IRRRL), commonly known as the VA Streamline Refinance. This isn’t just another refinancing option; it’s a strategic tool for Veterans & Active Duty aiming to enhance their financial well-being by reducing their monthly mortgage payments. Let’s dive in and discover how the IRRRL can make managing your mortgage easier and more beneficial.

Understanding the IRRRL

The IRRRL is your streamlined solution for lowering stubborn mortgage rates and swiftly reducing your monthly payments—without the usual paperwork pile-up. Specifically tailored for Veterans & Active Duty with VA Loans, this program offers an express lane to financial relief.

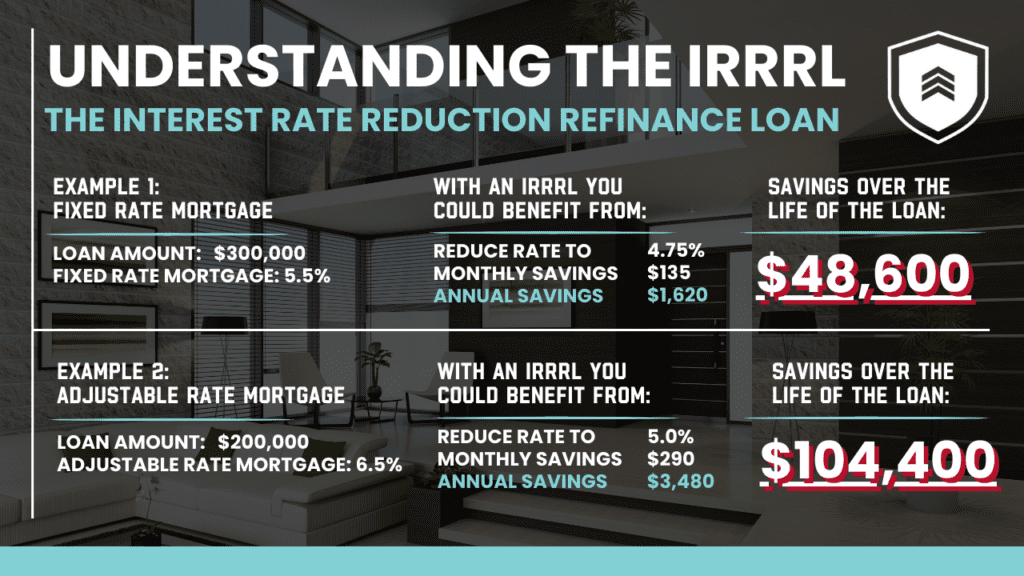

Consider these scenarios to understand potential savings:

Example 1: Imagine you’re locked into a fixed-rate mortgage at 5.5%. By utilizing an IRRRL, you might reduce that rate to 4.75%. On a $300,000 loan, this could mean saving approximately $135 monthly—adding up to $1,620 annually and $48,600 over 30 years. These savings could significantly impact your budget, allowing for investments or expenditures in other areas of your life.

Example 2: If you’re navigating an adjustable-rate mortgage at 6.5% and switch to a fixed rate of 5.0%, your monthly payments could decrease substantially—by about $290 on a $250,000 loan. Annually, this amounts to $3,480 in savings, summing up to an impressive $104,400 over the life of the loan. Such a change provides stability and frees up a considerable amount of cash each month for other financial priorities.

Key Benefits of IRRRL

- Lower Interest Rates: Secure a reduced rate and keep more money over the life of your loan.

- Reduced Monthly Payments: Extra cash each month? That’s always a welcome change.

- No Appraisal Required: Skip the hassle and expense of an appraisal.

- Simplified Paperwork: Experience a streamlined process with less bureaucratic clutter.

- No Cost Out Of Pocket: Most IRRRL Refinances will not require you to pay any fees out of pocket. Closing Costs on an IRRRL are more affordable than on a Purchase, and you can finance them into the loan amount.

- Skip One to Two Mortgage Payments: When you refinance your current mortgage, you will likely skip one mortgage payment, possibly even two mortgage payments, depending on when you close.

Eligibility Requirements for IRRRL

To participate in this program, you’ll need:

- A VA Loan: Your current mortgage must be VA-backed.

- Refinance a Delinquent VA Loan: Any IRRRL made to refinance a loan that will be 30 days or more past due as of the date of closing, must be submitted to the VA for prior loan approval. The lender must first obtain sufficient information and perform sufficient analysis to determine that: the cause of the delinquency has been resolved, and the veteran is willing and able to make the proposed loan payments.

- Occupancy: You can refinance your Primary Residence or a Rental Property using the VA IRRRL. If you are refinancing a rental/investment property, you must have initially occupied this home as your primary residence.

Additional Considerations from Lenders

Some lenders might have further requirements:

- Clean Recent Payment History: No late payments over 30 days in the last year –

Veterans Lending Group can refinance a delinquent VA Loan, as long as the VA will approve the loan.

- Seasoning Period: You must have completed at least six full monthly payments and 210 days must have passed since your first loan payment on the loan you are refinancing.

Documentation Needed for IRRRL

Prepare the necessary paperwork:

- No Income and Asset Documentation: You do not need to provide income and asset documentation for an IRRRL unless you are paying your closing costs out-of-pocket, in which case you will need to provide asset documentation.

- VA Questionnaire and Identification: Confirm your basic eligibility and identity.

- Chapter 13 Bankruptcy Considerations: You may need to obtain approval from a trustee.

- Asset Statements: If you’re paying the closing costs out-of-pocket.

Additional Documentation for New Lenders

If you’re switching lenders, you might also need:

- Homeowners Insurance Policy Details: If you’re insured with USAA, include your member number.

- Previous Loan Documentation: Details from the loan you’re refinancing.

Conclusion

The IRRRL acts as a financial ally for Veterans, simplifying mortgage management and providing significant savings opportunities. By understanding and utilizing this program, you can take decisive control of your mortgage and move towards a more secure financial future.

Veterans Lending Group is here to support you every step of the way. We help you capitalize on every available benefit from your refinance.