For Veterans and active-duty members aiming to purchase a high-value home, a VA jumbo loan could be the key to unlocking your dream lifestyle. Jumbo loans provide financing up to $5 million, enabling you to buy luxury and high-cost homes that exceed conventional loan limits. Whether you’re upgrading your current living situation or buying your first home, a jumbo loan offers the flexibility and power you need.

What are Jumbo Loans?

A jumbo loan is a mortgage that exceeds the conventional lending limits set by the Federal Housing Finance Agency (FHFA). These limits, generally capped at $726,200, define the maximum loan amount that Fannie Mae and Freddie Mac will purchase. In some areas, the limits are higher. But Jumbo loans let you finance more expensive properties that standard loans can’t cover.

Jumbo Fixed Rate Mortgages

Jumbo loans can be structured with a fixed interest rate, providing consistency, stability, and long-term predictability. With this type of loan, your interest rate and monthly payments remain the same throughout the loan term. The term can range from 10 to 30 years. This option is ideal if you plan to stay in your home for an extended period. It protects you from market fluctuations and allows you to refinance if interest rates drop.

Pros:

- Your interest rate is set and won’t change over time.

- Monthly payments remain stable, regardless of market conditions.

- Protection against rising interest rates.

- Potential to refinance if market rates decrease.

Cons:

- The initial interest rate may be higher compared to other loan options.

- Monthly payments may be higher, especially at the beginning.

- No automatic reduction in payments if market rates fall.

Exceptional Benefits of VA Jumbo Loans

Veterans and active-duty members can leverage specific benefits with a VA jumbo loan. These benefits make it an even more attractive option:

- No Minimum Credit Score Requirement: VA jumbo loans often have more lenient credit score requirements, making them accessible to more Veterans.

- Zero Down Payment: For those without a current VA home loan, it’s possible to secure a jumbo loan with no down payment.

- Seller-Paid Closing Costs: Sellers can contribute up to 6% of the purchase price toward your closing costs, helping to ease the upfront financial burden.

- Flexible Refinance Options: Veterans can refinance their existing loans to release their VA entitlement or take advantage of lower interest rates.

- Continued Eligibility After Financial Hardship: Veterans remain eligible for a VA jumbo loan even after financial difficulties like foreclosure, divorce, or bankruptcy.

- Investment Opportunities: Use your VA jumbo loan to purchase multi-family properties, opening the door to lucrative investment opportunities.

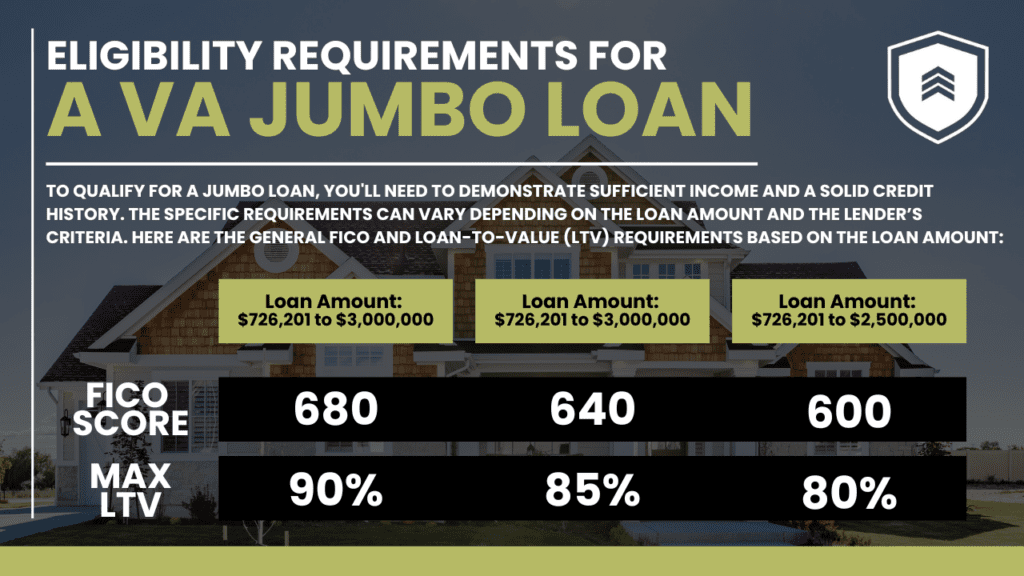

Eligibility Requirements for a VA Jumbo Loan

Wrapping Up VA Jumbo Loans for Veterans

A jumbo loan can be a powerful tool for Veterans and active-duty members. It’s especially useful for those looking to purchase a high-value home. With loan amounts up to $5 million, VA jumbo loans offer unique benefits. These include no minimum credit score, zero down payment, and flexible refinancing options. This financing option is ideal for maximizing your home-buying power.

You can tailor a jumbo loan to fit your financial strategy and long-term plans. However, always consult with a knowledgeable mortgage professional to explore your options and find the best loan for your needs.

For more information on VA loans and how to take advantage of your benefits, visit Veterans Lending Group.