Rate Alerts Are Essential for a Successful Refinance

If you’re considering a refinance on your mortgage, signing up for rate alerts from Veterans Lending Group could be an excellent strategy. Refinancing is a powerful financial tool, and timing is crucial. Let’s explore how rate alerts can be essential to your refinancing strategy and how they can help you secure the best terms available.

Why You Should Refinance

Refinancing replaces your existing mortgage with a new one under better terms. This could mean obtaining a lower interest rate, reducing your monthly payments, or accessing your home equity for large expenditures. Refinancing can enhance your financial situation whether you’re looking to decrease costs or manage your debt more efficiently.

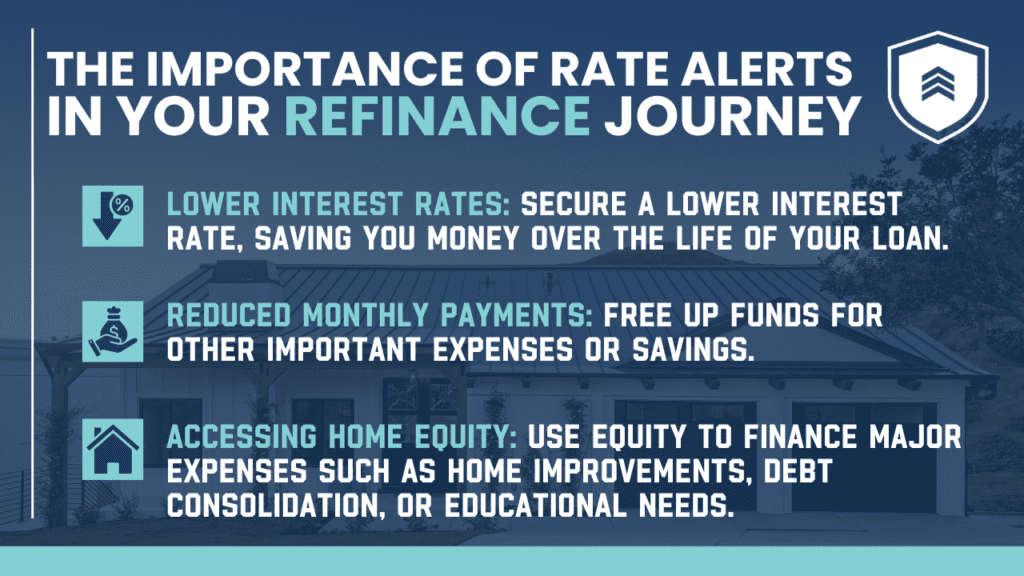

Benefits of Refinancing

- Lower Interest Rates: One of the primary reasons to refinance is to secure a lower interest rate, which can save you a significant amount of money over the life of your loan.

- Reduced Monthly Payments: Lower payments can free up funds for other important expenses or savings, providing more financial flexibility.

- Accessing Home Equity: Use your home’s equity to finance major expenses such as home improvements, debt consolidation, or educational needs.

The Importance of Rate Alerts in Your Refinance Journey

What are Rate Alerts?

Rate alerts act like your personal financial watchdog, notifying you when mortgage rates fall to levels that could benefit your refinancing goals. By setting up these alerts, you’ll be positioned to take advantage of refinancing opportunities as soon as they arise.

Why Rate Alerts Are Essential

- Timely Information: Mortgage rates fluctuate frequently, and rate alerts ensure you never miss out on lower rates that can benefit you.

- Maximize Savings: Securing a lower rate at the right time can significantly reduce the cost over the life of your mortgage.

- Stay Informed: Keeping up with market trends through rate alerts empowers you with the information needed to make informed refinancing decisions.

How to Get Started with Refinance Rate Alerts

Simple Sign-Up Process

No complicated steps are required! Right here on this blog, you’ll find an easy-to-complete rate alert form. Just enter your details and set your rate preferences. We will monitor the market for you and alert you when the conditions are ideal for refinancing. It’s that simple!

Customizable Alerts

Customize your rate alerts to suit your specific needs:

- Desired interest rates

- Loan types

- Specific refinancing goals

Benefits of Signing Up with VLG

- Expert Guidance: Our team of VA Home Loan Experts are ready to help you determine the optimal times to refinance, tailored to your unique financial circumstances.

- Comprehensive Support: We support you from start to finish, ensuring you make the most of your refinancing journey.

Evaluate Your Goals

Before you start, it’s crucial to understand exactly what you hope to achieve through refinancing. Are you aiming for lower monthly payments, a better rate, or to tap into your equity? Identifying your goals helps you navigate the refinancing process effectively.

Choose the Right Lender

Working with a trustworthy lender is key. Veterans Lending Group specializes in guiding Veterans toward their financial objectives with top-tier refinancing options. We are committed to securing the best possible terms for you.

Stay Adaptable

The financial market is dynamic, so being adaptable is essential. With rate alerts, you’re always prepared to act quickly when the best opportunities arise.

Conclusion: Rate Alerts are the Key to a Successful Refinance

Refinancing your mortgage is more than just a number game; it’s a strategic decision that can greatly enhance your financial health. With rate alerts, you stay well-informed and ready to capture the best terms as soon as they become available. Ready to improve your financial outlook? We’re here to help every step of the way.

Refinance

Refinance