Today, we’re diving deep into how the VA loan works, exploring some fantastic benefits and lesser-known aspects that might just surprise you.

Eligibility Requirements: More Than Meets the Eye

VA loans are a hallmark of military service, offering exceptional benefits to those who’ve served. But it’s not just service members who benefit; spouses of Veterans who died in service or from service-related disabilities are also eligible. And yes, this includes our National Guard and Reserve members, after certain service benchmarks are met.

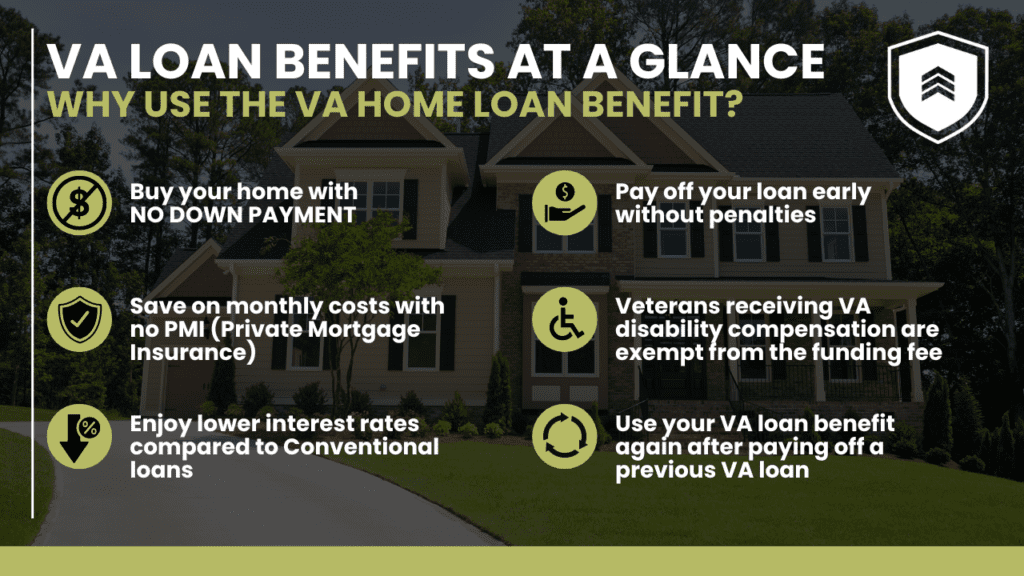

Benefits of a VA Loan: Not Just the Basics

No down payment? Check. No private mortgage insurance? Absolutely. Competitive interest rates? Definitely. But the real kicker? The absence of a prepayment penalty, which allows you the freedom to pay off your loan on your own terms—something many borrowers are pleasantly surprised to discover.

Lesser-Known Features: Hidden Gems of VA Loans

Did you know your VA home loan benefit is reusable? That’s right—if you’ve fully paid off your previous VA loan, you can use the benefit again for another home purchase. Plus, if you ever decide to sell, your loan can be assumed by another eligible buyer, potentially making your home more attractive in a competitive market.

The Funding Fee and Exemptions: Crucial Cost-Savers

The VA funding fee helps sustain the loan program for future Veterans, but not everyone has to pay it. Veterans receiving VA disability compensation are exempt, as are certain surviving spouses. Knowing whether you qualify for an exemption can save you a significant amount.

The Loan Process: Clearing Up Confusions

Navigating the VA loan process can be smoother with a knowledgeable lender familiar with VA requirements. From pre-approval to closing, understanding steps like the VA’s specific appraisal process and minimum property requirements can prevent any last-minute hurdles.

VA Loan Limits and Jumbo Loans: Expanding Your Options

While VA loans used to have limits, recent changes mean that in many areas, you can now borrow as much as your lender deems you can afford, without needing a down payment. For pricier homes, a VA Jumbo Loan might be your ticket to buying in a high-cost area.

Challenges and Solutions: Expert Tips

Occasionally, some sellers might hesitate when they hear “VA loan” due to misconceptions about the process. Arming yourself with knowledge and partnering with a proactive military loan specialist can help demystify the benefits to sellers and smooth out the transaction process.

Congratulations: Now You Know How The VA Loan Works

VA Home Loans are a powerful tool in your homebuying arsenal, designed to honor your service with benefits that truly matter. Whether you’re buying your first home or your next, understanding these nuances can empower you to make the most of your benefits.

Thinking of exploring your loan options? Reach out to us at Veterans Lending Group—let’s ensure you get every advantage you deserve in your homebuying journey.