Exploring Zero Down Loan Options for Veterans

Navigating the path to homeownership can often feel like an overwhelming challenge, especially when financial hurdles appear insurmountable. For Veterans and military families, however, unique opportunities like zero down loans are available, paving the way to easily accessible homeownership. In this blog, we will explore how zero down loans work and how they intertwine with VA home loan benefits, ensuring that our nation’s heroes find their way home with ease and financial peace.

Understanding Zero Down Loans: What Are They?

Zero down loans eliminate the need for a down payment, one of the most significant barriers to homeownership. For Veterans, the VA home loan stands out as a prime example of a zero down loan option, offering not just reduced entry costs, but also favorable terms compared to traditional mortgage products. This special provision, provided by the U.S. Department of Veterans Affairs (VA), is designed to honor those who have served. It requires no down payment, no private mortgage insurance, and offers competitive interest rates.

How Veterans Benefit From VA Home Loans

The VA home loan is more than just an opportunity to buy a home without a down payment; it’s a token of gratitude from the nation to its service members. By leveraging this benefit, Veterans can secure homes without the upfront financial burden that often comes with large purchases. Moreover, the qualification criteria for VA loans are generally more flexible than those for conventional loans, making homeownership accessible even to those who might struggle with securing traditional financing.

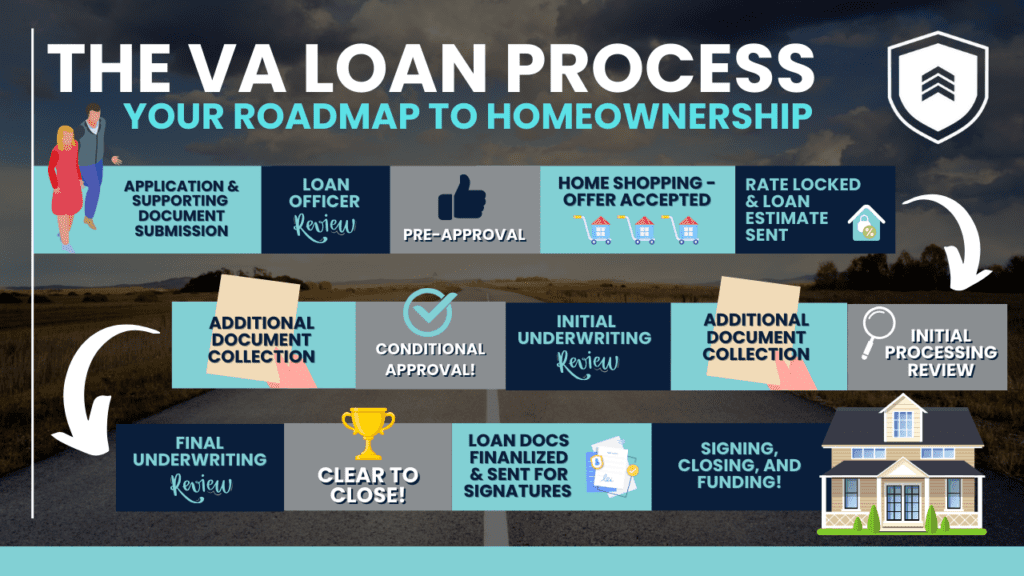

Step-by-Step: Securing a VA Home Loan

- Eligibility Check: First, Veterans must confirm their eligibility for the VA loan benefit, which is based on service duration and discharge conditions.

- Certificate of Eligibility: Obtain a Certificate of Eligibility (COE), which is a must-have to proceed with a VA loan application.

- Loan Shopping: Veterans should compare different VA-approved lenders to find the best interest rates and terms.

- Loan Application: Apply for the loan with your chosen lender, providing all necessary documentation, such as income, credit, and employment details.

- Home Search and Appraisal: Once pre-approved, you can start house hunting. The property will need to pass a VA appraisal and meet minimum property requirements.

- Closing the Deal: Finalize the sale and sign the mortgage agreement to take ownership of your new home.

Veterans looking for more information on VA loans can visit Veterans Lending Group for tailored advice and detailed walkthroughs of the application process.

In Closing

Zero down loans, particularly the VA home loan, offer a significant advantage for Veterans, allowing them to transition smoothly into homeownership without the financial strain typically associated with purchasing a home. By understanding and utilizing these benefits, Veterans can secure a stable future and enjoy the comforts of a new home without the burden of upfront costs.

For Veterans embarking on the journey of securing a home loan, remember that resources and support are plentiful. You served us; now let us help serve your dreams of homeownership.

With these insights and the right approach, the path to owning a home with zero down is not just a possibility, but a tangible reality for our Veterans. Dive into the world of zero down loans and make an informed decision that could lead you to the doorstep of your new home.